ii. Personal Financial Planning

If you fail to plan, you are planning to fail. Honestly, practicing money management isn’t that hard to figure out. In many ways it’s similar to playing a video game. The first time you play a game, you may feel awkward or have the lowest score. Playing for a while can make you OK at the game. But if you learn the rules of the game, figure out how to best use each tool in the game, read strategy guides from experts, and practice, you can get really good at it.

Photo by Oli Woodman on Unsplash

Money management is the same. It’s not enough to “figure it out as you go.” If you want to get good at managing your money, you must treat money like you treat your favorite game. You have to come at it with a well-researched plan. Research has shown that people with stronger finances are healthier (Sweet et al., 2013) and happier (Kozma & Stones, 1983), have better marriages (Drew, Britt, & Huston, 2012), and even have better cognitive functioning (Mani et al., 2013).

Financial Planning Process

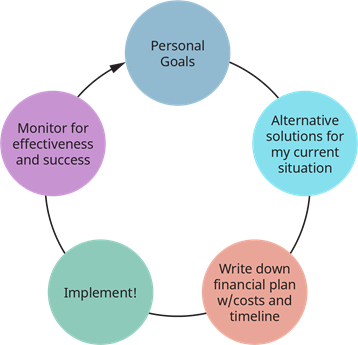

Personal goals and behaviors have a financial component or consequence. To make the most of your financial resources, you need to do some financial planning. The financial planning process consists of five distinct steps: goal setting, evaluating, planning, implementing, and monitoring.

- Develop Personal Goals

- What do I want my life to look like?

- What do I really need?

- Identify and Evaluate Alternatives for Achieving Goals for My Situation

- What do my savings, debt, income, and expenses look like?

- What creative ways are available to get the life I want?

- Write My Financial Plan

- What small steps can I take to start working toward my goals?

- Implement the Plan

- Begin taking those steps, even if I can only do a few small things each week.

- Monitor and Adjust the Plan

- Make sure I don’t get distracted by life. Keep taking those small steps each week. Make adjustments when needed.

Figure 1 – Steps of financial planning. (Credit: Amy Baldwin / Understanding financial literacy: Personal financial planning / Attribution (CC-BY 4.0))